ビットコインドル建てBTCUSDT相場レポート2025(9/13~9/19)Bitcoin Weekly Market Report

日本語/English

【この一週間のビットコインの値動き】

水曜日はFOMCがあり、FederalFundsRateのターゲットレンジを4.00~4.25%に引き下げ(0.25%の利下げ)が発表され、米国の金融政策が変わるとても大事な1週間でした。また、この週は新規失業保険申請数はマーケットの予測を下回り、雇用が悪化している感じはしません。その前週はかなり増えてましたが天災による一時的な増加の可能性が高い(ただしテキサス州での洪水は7月初旬でこんなにタイムラグがあるのかは疑問)。

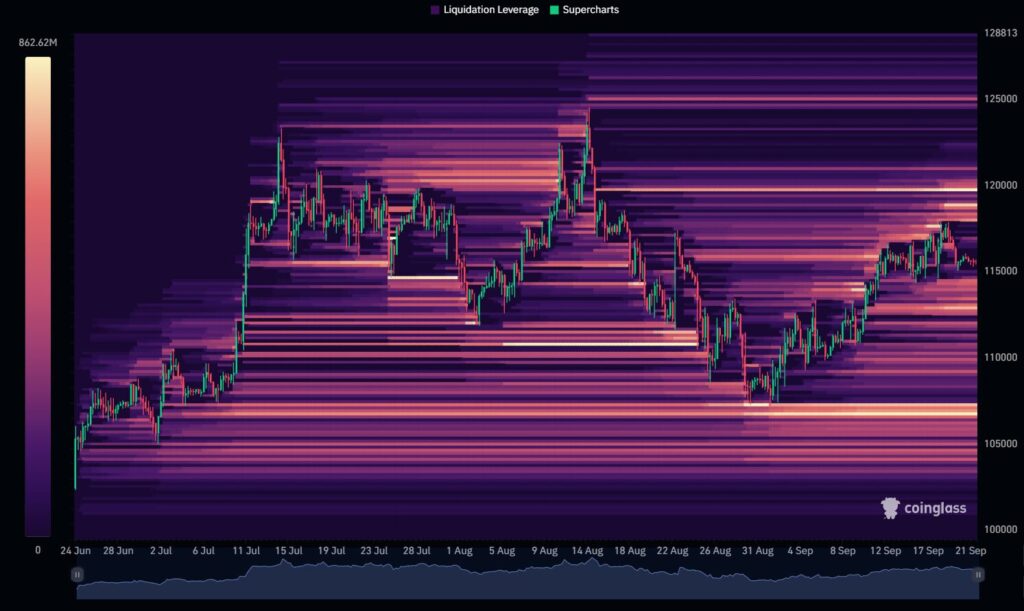

FOMC前に117200ドルでショートをエントリーしましたがロンドンマーケットにはクローズしてFOMC前後は静観しました。LiquidationMapでは118000ドル付近に清算がたまっていたのでショートエントリーの根拠として117900ドルで現在はショートポジションを持ってます。日足で調整波Cが決まるなら9万ドル後半から10万ドル、下落が浅いなら105000ドルまで下落が進行すると予想してます。

118000ドルをローソク足の実体で大きく突き破る展開が来るなら122000~123000ドルまで安易にはショートできないと考えてます。1週間足は大きな陽線なので全然あり得ます

日足は下髭の無い大きめの陰線になってるのでトレンドが下に出やすい状態だと感じます。

【現物(SPOT)マーケット】

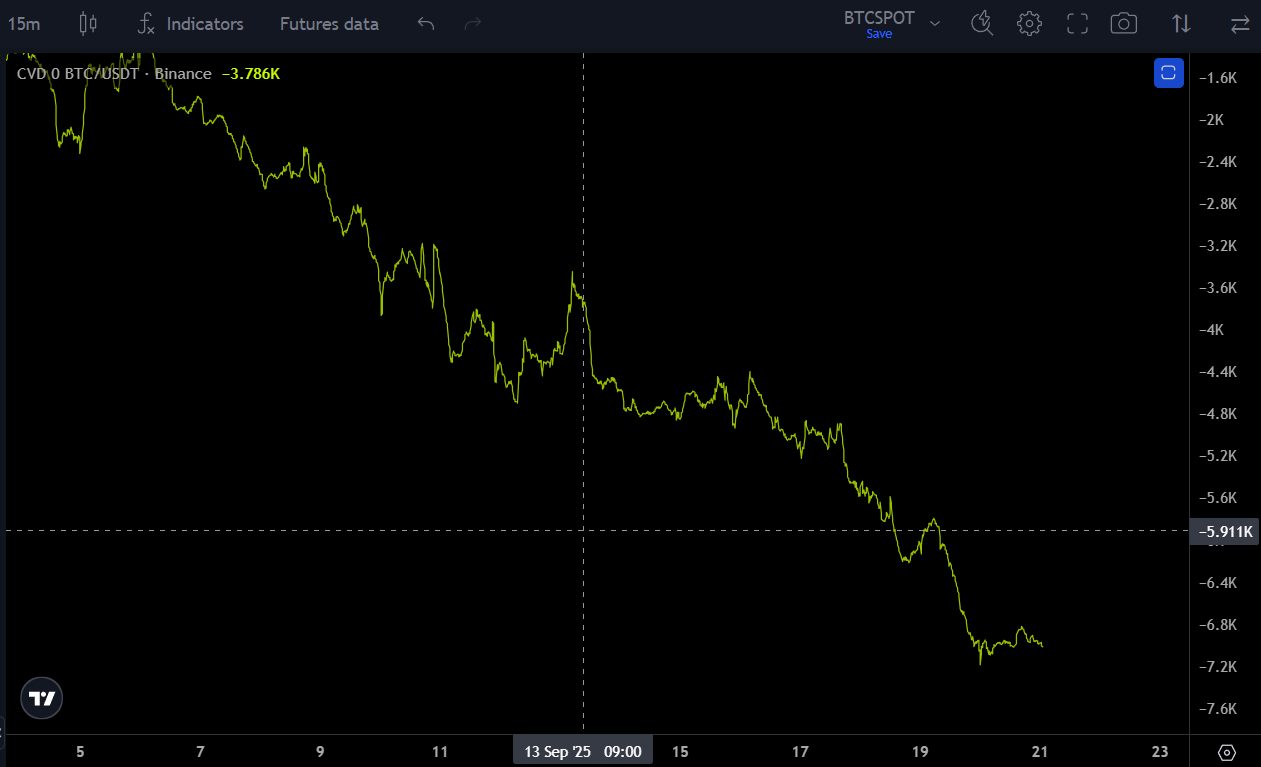

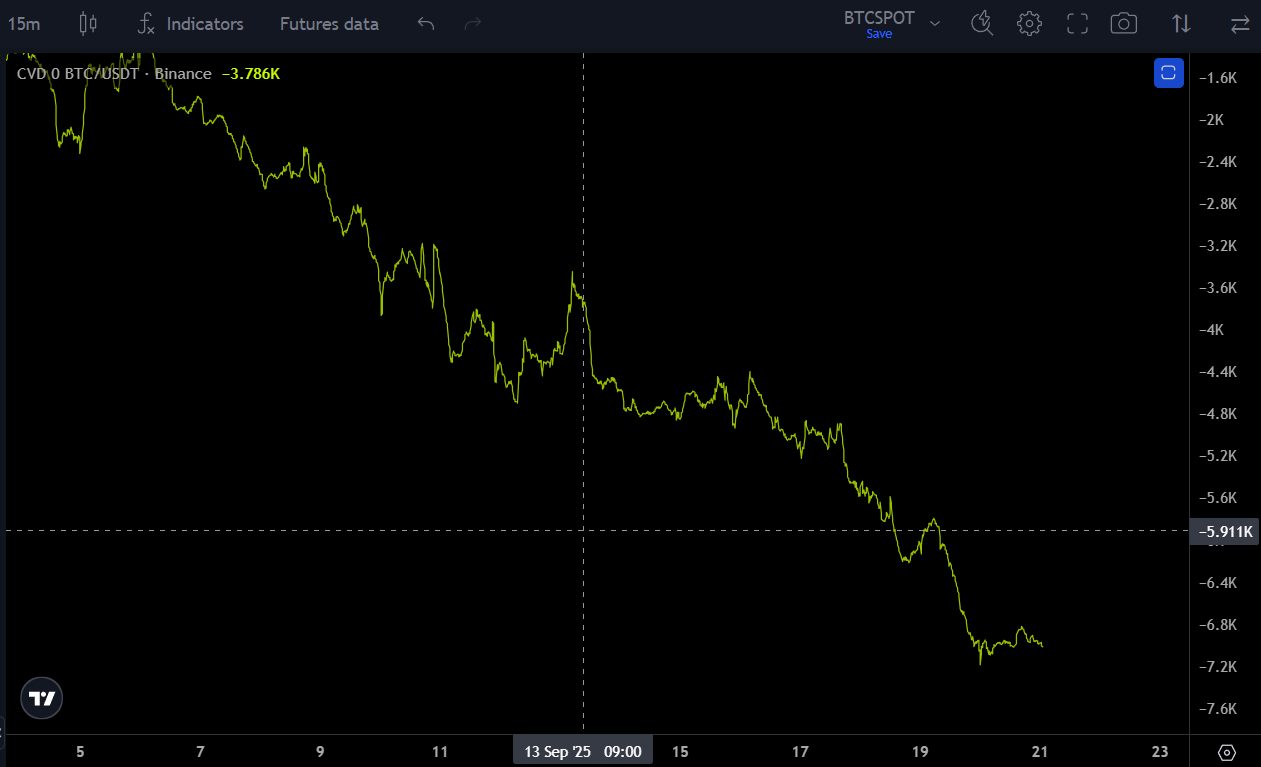

13日以降はバイナンスのSpotは成行売りが主、売りの指値板は117000~118000辺りでかなり貼られていました。

CoinbasePremiumは+を継続

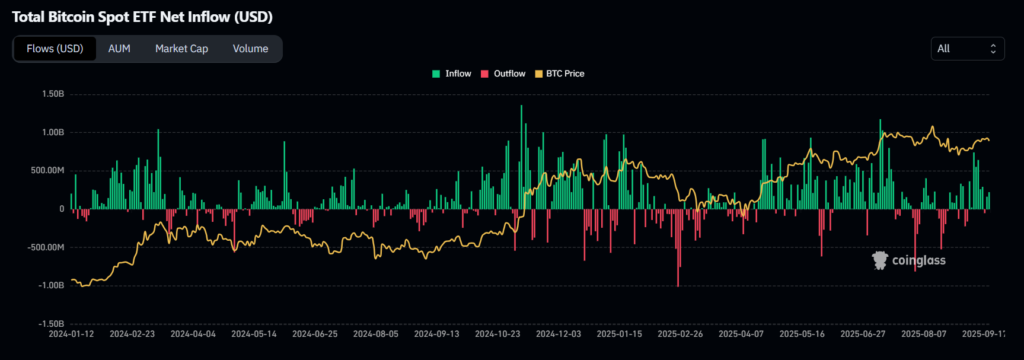

SpotETFはインフローを継続

【無期限先物(Perpetual)マーケット】

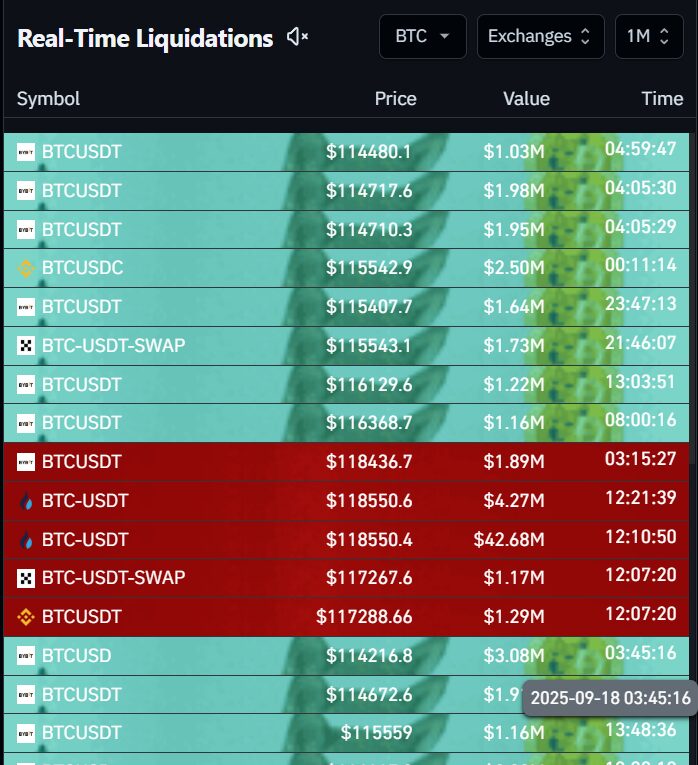

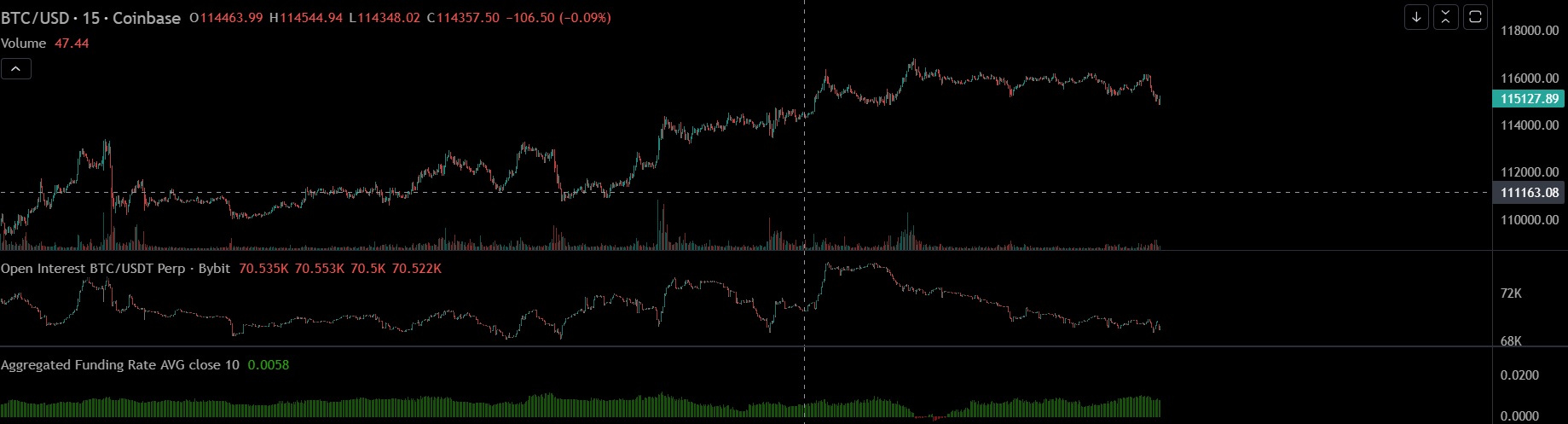

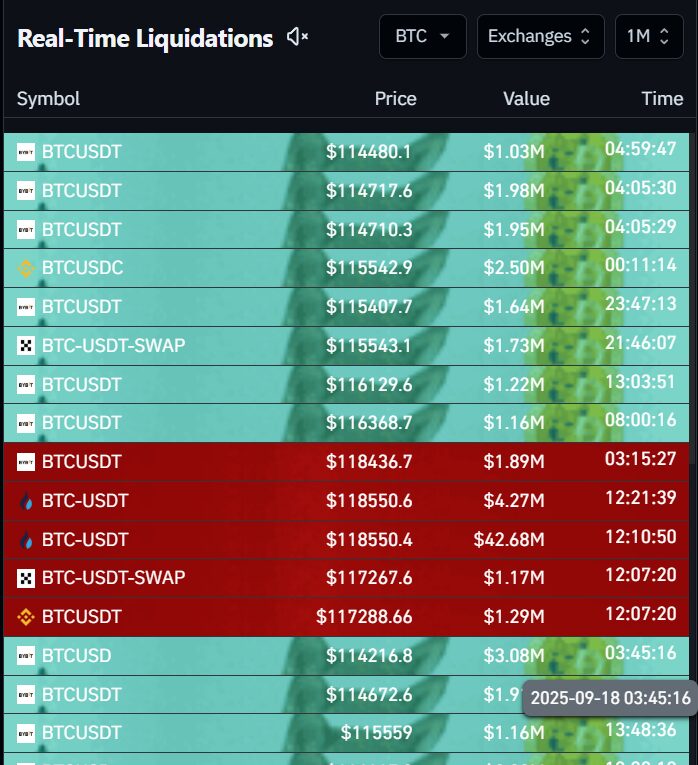

118000ドルに到達時にはHTXで42Mドルのショート清算がありました。

下の価格帯ではLiquidationMapを見ると113000ドルや107000ドル付近に清算が集中しています。

English

Until I get used to English, I use AI for translation

【What was Bitcoin’s price action this week?】

This past Wednesday’s FOMC meeting was a very important one, as the Federal Reserve announced a 0.25% rate cut, lowering the target range for the federal funds rate to 4.00–4.25%. This marks a shift in U.S. monetary policy. In addition, weekly initial jobless claims came in below market expectations, suggesting that employment conditions do not appear to be deteriorating. The previous week had shown a significant increase, but that was most likely due to temporary factors such as natural disasters. (That said, since the floods in Texas occurred in early July, it is questionable whether such a long time lag can be attributed to that event.)

Before the FOMC, I entered a short position at $117,200, but I closed it during the London session and stayed on the sidelines around the FOMC announcement. According to the liquidation map, there were clustered liquidations around $118,000, which provided the rationale for my current short position at $117,900. If a corrective wave C forms on the daily chart, I expect the decline to extend to the upper $90,000s to $100,000. If the pullback is shallow, I project a drop toward $105,000.

If price action decisively breaks above $118,000 with strong candlestick bodies, then I believe shorting becomes difficult until around $122,000–$123,000. Given that the weekly candle closed as a strong bullish bar, such a scenario remains quite possible.

On the daily chart, a large bearish candle without a lower wick has formed, which suggests that the trend is more likely to extend to the downside.

[Spot Market]

Since the 13th, market orders on Binance Spot have been predominantly sell orders, with a significant number of limit sell orders stacked around the $117,000–$118,000 range.

The Coinbase Premium has remained positive.

Spot ETFs have continued to see inflows.

[Perpetual Futures Market]

At the time when the price reached $118,000, there was $42 million in short liquidations on HTX.

On the downside, the Liquidation Map shows clusters of liquidations around the $113,000 and $107,000 levels.